Home Finance

Secured Credit Cards to Build Credit

The functionality of secured credit cards is very similar to that of ordinary credit cards. A cash deposit is typically required when applying for a secured credit card in order to secure the credit limit. When you open an account for a secured credit card, you must make a monetary security deposit to get the card. The credit card issuer can withdraw the money from your deposit if you don't pay your bill, which lowers the risk the issuer takes by extending credit to you. People with poor credit or no credit can apply for these cards for this reason. Choose from the best secured credit cards to build credit.

Who Does Need to Think About Getting a Secured Card?

If you do not yet have a credit history, using a secured credit card may be the best way to establish one. Using a secured credit card might help you improve your credit score and get you closer to being approved for an unsecured credit card or other types of loans if you currently do not meet the requirements due to a low score.

How Does a Secured Card Work?

The majority of well-known credit card firms, as well as banks, are the institutions that provide secured cards. Just as with a regular credit card, you'll need to fill out an application to receive a secured card. If you are approved, you may use your protected card to make quick purchases and pay them back at any time.

Secured Vs Unsecured Credit Card

The primary distinction between secured and unsecured credit cards is the requirement of a security deposit to obtain a secured credit card, as opposed to the absence of such a requirement for unsecured credit cards.

A secured credit card operates in the same manner as an unsecured credit card, except for the requirement to make a security deposit.

Secured Credit Card to Build Credit

If you use a secured credit card to build credit responsibly, it can be one of the simplest and quickest ways to improve your credit history, but only if you want to do so. Building your credit history can be accomplished with the help of a secured credit card. So select the best secured credit cards to build credit.

Apply for a Secured Credit Card to Build Credit

When looking for a secured credit card, you should select the one that best suits your needs.

After you have chosen a card, the issuer will most likely examine your credit and your income, asking you to make a cash deposit. This deposit is deposited into a protected account and won't be returned to you until you either successfully cancel your card while it's in good standing or switch to an unsecured credit card offering if that's an option made available by the company that issued your credit card.

Make use of your secured credit card, but try not to overspend with it

After you have completed the security deposit payment and received your secured credit card, you should make it a routine to use the card regularly. This is because maintaining responsible spending patterns with credit cards helps develop credit.

Keep all of your receipts, check your balance frequently, and try to keep your balance as low as possible. Make sure you have a plan to pay off your balance, but it doesn't matter how high your balance gets if you don't have one.

Using your credit card to make purchases will not cause a rise in the price of the products or services that you acquire so long as the statement balance is paid in whole and on time. Because missed payments and excessive balances can both have a negative impact on your credit score, it is essential to keep close track of both the money you spend and the amount that you pay back.

Be punctual with the payments you make on your credit card

Paying the statement balance on time is the most critical routine to get into with your brand-new secured credit card, so make sure to make it a habit. Your credit score is affected by late payments more than one-third of the time. Building a solid credit history requires you to establish a history of making payments on time, which is vital to doing so and can help you save money in the long run.

When you initially acquire your credit card, make a note of the day your statement is due and mark that date on your calendar. You can also stay on track with the assistance of mobile payment apps. Remember that amounts outstanding are also included in your credit history, so make an effort to pay off your statement balance in full if at all possible; but, if this is not possible, at the absolute least, make sure to make the minimum payment on time.

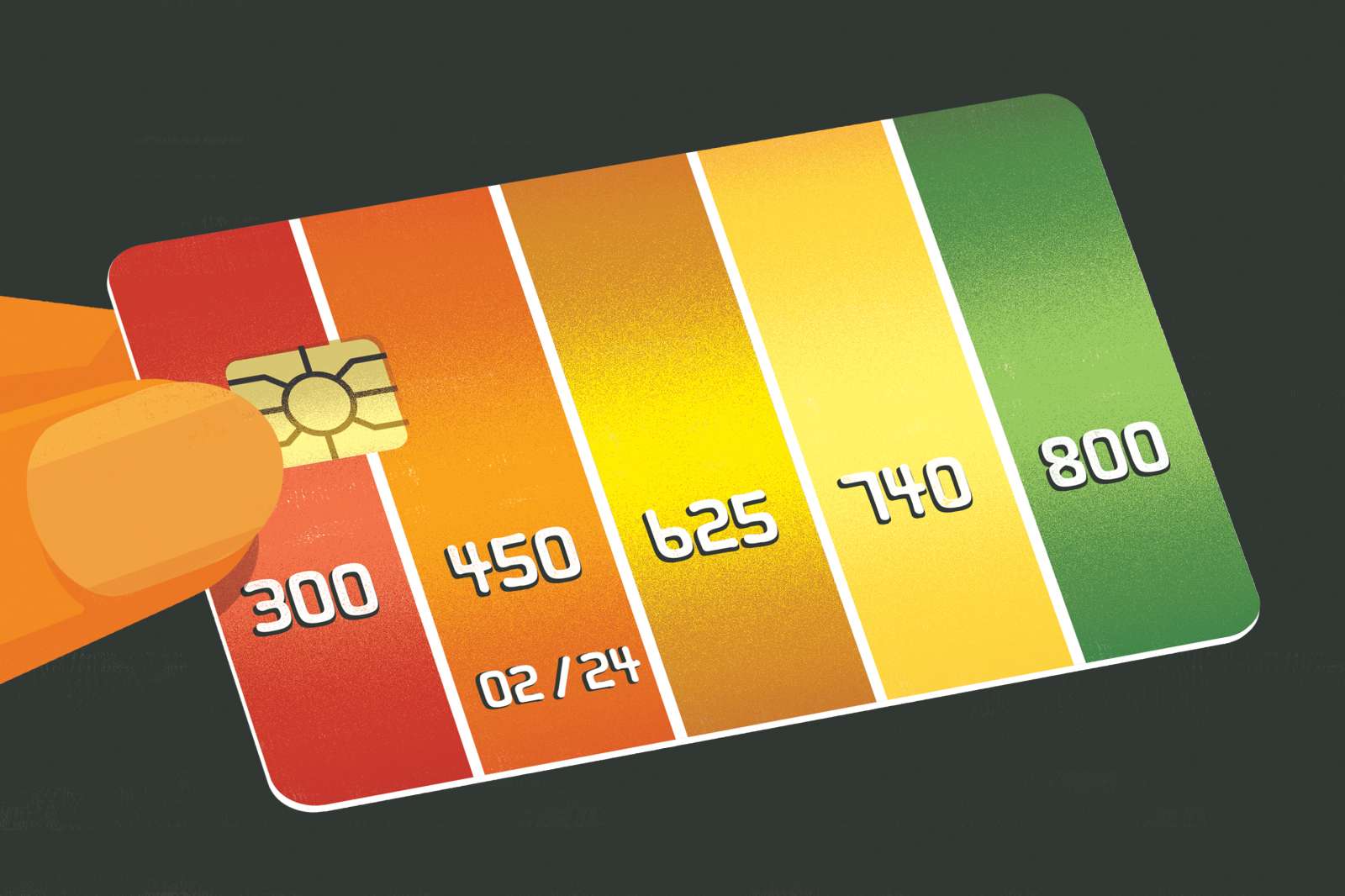

Keep an eye on your credit score

As you become more comfortable using your credit card, it is smart to keep an eye on your credit score and your credit history. The company that issued your credit card may provide free access to your score. It is possible to watch it increase over time if payments are made on time and expenditure is kept under control. A high score is preferable because it increases the likelihood that you will be approved for unsecured credit cards with incentives and lowers the interest rate you will pay on other types of borrowing.

If you have been keeping an eye on your score and you see that it has suddenly plummeted, you should look over your credit reports. You are entitled to one free copy of all three reports annually at AnnualCreditReport.com. A good credit history can be yours for the taking if you make responsible use of your credit card, both in terms of how much you spend and how quickly you pay off your balance.